TT - Economic Committee of the National Assembly both macro-economic report 2012 titled "From macroeconomic instability to the path of restructuring." This report reviews various policy of VN difference, not even by the general trend of the world.

Macroeconomic Report 2012 is made in the framework of the project "Support for advisory capacity, verification and monitoring macroeconomic policies" by the Economic Committee of the National Assembly shall, with the financialsupport of the United Nations Development Programme in Vietnam (UNDP). The report raised several issues, including a review "growth type $" cause of prolonged macroeconomic instability, the risk of foreign investment in Vietnam reduced, spreading public expenditure, poor results ...

The population burden of taxes and charges

|

Tightening consumer spending, but the government has increased

In particular, even when priority control inflation (as in 2011), the Government called for strong fiscal tightening, but the report said: government consumption actually increased about 4%. "Paradoxically later than 20 years from a centrally planned economy to a market economy, the scale of government spending $ has increased from about 22 percent in 1990 to more than 30% of GDP in 2010" - report of the economic Committee of the National Assembly wrote.

|

However, notable for the first report of the Economic Committee of the National Assembly and the least in-depth analysis: high duty in Vietnam, are reducing the possibility of accumulation of business and are important reasons why thetransfer of the business.

The report analyzes such as personal income tax, taxable income of $ lower taxable but higher than China and Thailand. With income $ 3451-5175 / year, the U.S. has been subject to a tax rate of 10%.While the corresponding figure in Thailand and China respectively 4931-16434 USD / year and 3801-9500 USD / year.Similarly, the corporate income tax rate of 25% also applies a fixed way for the majority of enterprises in when applied several countries from 2-30%.

In addition, Vietnam has imposed high taxes such as excise taxes and import duties. And yet, Vietnamese businesses have to pay the high unofficial costs. Led a recent study reported that up to 56 percent now participate in bidding for state projects that the commission is common.

The report also said the tax revenue-to-GDP ratio in the U.S. is now higher, has limited ability to accumulate, reducing the ability to invest ... of the private sector. It also encourages tax fraud, such as the phenomenon of transfer pricing of foreign-invested enterprises (FDI). FDI accounted for 20% of GDP but contributes only about 10% of the total budget should report that to tax higher than other countries in the region to create attractive engine for FDI profit transfer abroad to enjoy the enterprise income tax rate lower.

|

|

|

Đồ họa: V.Cường - Ảnh: Thuận Thắng

|

Taxes, fees from 1.4 to 3 times the water

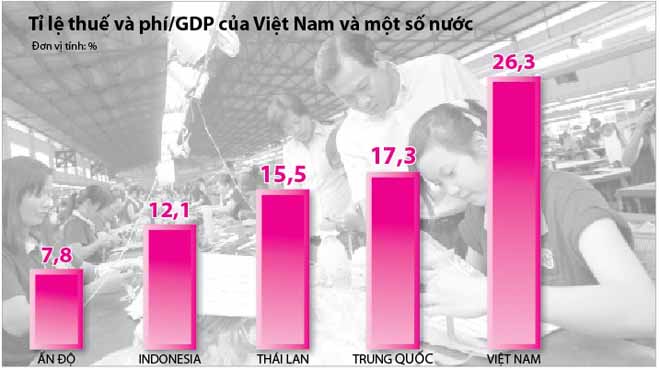

State budget settlement of the Ministry of Finance, the report of the Economic Committee of the National Assembly said the average for the period 2007-2011, total state budget revenue of $ up to 29% of GDP. If only the revenue from taxes and charges, the figure was 26.3% of GDP. According to Mr. Pham The Anh, Director of the Institute for Public Policy and Management Hanoi National Economic University, who made the report, the revenue from taxes and charges, excluding crude oil, the VN now "is very high compared to other countries in the region." Specifically, the average in recent years, the rate of tax and fee revenue / GDP of China is 17.3%, Thailand and Malaysia about 15.5%, 13%, Indonesia 12.1% and of India is only 7.8%.

Assessment Report in addition to the "inflation tax" every year at double-digit levels, the protectionist policies and overlapping taxes are made each Vietnamese people suffered taxable rate, charge / GDP higher than 1,4-3 times higher than other countries in the region. Meanwhile, according to Pham The Anh, the way to reduce the budget deficit through tax increases and tax base is very limited. The increase in revenue can only be done through measures to improve compliance rates, revenue loss and anti-smuggling.

Worrisome, the report reviews the total tax and fee of Vietnam mainly comes from three main sources, which is the value added tax, corporate income tax and import and export duties and excise duties on imported goodsexport. But the share of corporate income tax tends to decrease from 36% in 2006-2008 to 28% in 2009-2011. Large dependence on import tax and special consumption may cause budget deficit of $ aggravated tax cut route shall comply with commitments to the World Trade Organization in the coming years.

The report also stated that two important current income is from the sale of the state-owned land use right transfer and even take into account the balance of the budget may reduce the severity of the deficit situation, but also to warn the nature of this source of income is the same as an individual to sell assets to expenditure. "The loan debt he can reduce his asset but also a corresponding reduction, which meant he was poor," the report said.

Persistent high budget spending

With the collection of the above, the report of the Economic Committee of the National Assembly also focused analysis of government spending. Large public investment report states, scattered and ineffective. Mr. Pham Anh analysis: "We can see the public sector's investment spread across all sectors, from the activities in the field of public security, defense, education, health ... . to the business activity of pure processing industry, mining, arts, entertainment ... In particular, the share of investment in the real estate business sector, finance, banking, construction, accommodation services has increased dramatically from 1.9% in 2006 to about 4.8% of total investment investment in 2010. "

Notably, the report stated in total expenditure, recurrent expenditure (ie expenditure for apparatus such as salaries, office expenses, electricity, water ...) up a very large proportion of spending for investment and developmentback up a much smaller proportion and tends to decrease.The report highlights current expenditures are increasing, from 63.2% of total expenditure in 2003 to 71.7% in 2010 and 75.4% in 2011. This part shows that the bulky and costly expenditure of the system of government.

Consequence of the budget report stated: average in both 2010 and 2011 the Vietnamese government debt has more than 110,000 billion / year through the issuance of domestic bonds. This figure is almost double compared to 56,000 billion per year in 2007-2009. With this situation, the report of the Economic Commission warns Congress government spending once they exceed certain threshold will hinder economic growth because it causes the allocation of resources in an effective way, corruption losses and pinched the private sector. Real world indicates that the quality or effectiveness, rather than the scale of government spending is an important factor to decide the growth rate and the level of development of each country.

|

Mr. Nguyen Ngoc Hung (Vice Chairman of the HCM City Business Association):

Business income tax under 18% / year is reasonable

Corporate income tax rate of 25% applies fixed for every business today is too high, not to business to be profitable in the current difficult context, note cumulative mention, at wherefrom. To ensuring state budget revenues, has to be profitable enough business and get the necessary cumulative tax rate less than 18% / year may receive the consent of the business. Particularly with the personal income tax, the crystal again to enter taxable and breaking down sidestep tax. If possible, to reduce personal income tax more to enable the purchasing power of the people, free to air out all the new corporate structure and resolve the problem of inventory.

Cao Tien Vi (Chairman of the Board of Directors Sai Gon Paper Joint Stock Company):

Corporate tax revenue has very

Needs a more extensive survey of stamina tax rates to both local people and businesses are jealous. For rent represents the pinnacle of the administration of a nation. Corporate income tax of 25% is not the core issue, which is important to state policy entrepreneurial How hire enough endurance, encourage business development, reinvestment. If the high rental income, that only "no minorities" to collect, the state still obtained. The calculation and collection of taxes in a fair, collected rent in the number of lines with a scale appropriate for the size and type of each enterprise is the state need to consider and research.

T.V.N. ghi

|